|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

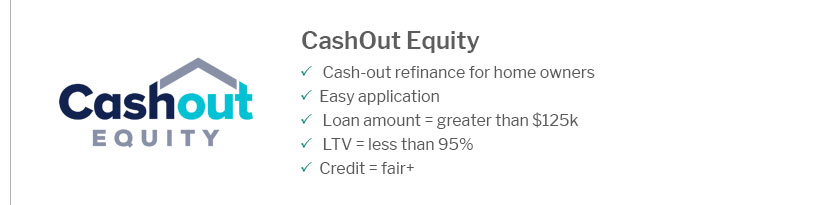

Understanding Cash Out Refinance Options for HomeownersCash out refinance options are financial tools that allow homeowners to access the equity in their homes. This process involves replacing your existing mortgage with a new one that is higher than what you currently owe, providing you with the difference in cash. How Cash Out Refinancing WorksWhen you opt for a cash out refinance, you essentially take out a new loan to pay off your existing mortgage. The new loan is larger, and the difference between the old loan and the new loan is given to you as cash. Eligibility RequirementsTo qualify for a cash out refinance, homeowners typically need a good credit score, a stable income, and a certain amount of home equity. Lenders often require at least 20% equity in the home. Benefits of Cash Out Refinancing

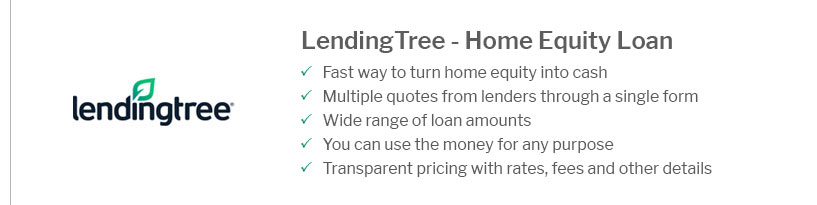

Comparing with Other OptionsIt's crucial to compare cash out refinance options with other financial tools. For instance, using a refinance or home equity loan calculator can help you understand the costs and benefits of different choices. Home Equity Loan vs. Cash Out RefinanceUnlike cash out refinancing, a home equity loan is a separate loan on top of your existing mortgage. This option might be more suitable if you prefer a fixed-rate loan with a fixed repayment term. Considerations and RisksWhile cash out refinancing can provide financial relief, it's important to consider the risks. Increasing your loan balance could lead to higher monthly payments or extend your loan term.

It's essential to evaluate your financial situation carefully. If you're considering using the funds to purchase another property, you might explore the option to refinance to buy a second home. Frequently Asked Questions

By carefully weighing your options and understanding the process, cash out refinancing can be a strategic financial move. https://sf.freddiemac.com/working-with-us/origination-underwriting/mortgage-products/cash-out-refinance

Cash-out refinance mortgage options can help borrowers leverage home equity for immediate cash flow. Whether borrowers want to consolidate debt or obtain ... https://www.rocketmortgage.com/learn/cash-out-refinance

A cash-out refinance is a type of mortgage refinance that takes advantage of the equity you've built over time and gives you cash in exchange for taking on a ... https://www.navyfederal.org/makingcents/home-ownership/cash-out-refinance.html

Most lenders generally allow you to borrow up to 80% of your home's value. The exact amount depends on your home's value, your existing mortgage, your credit ...

|

|---|